Breaking News: Unilorin Alumi Association: 'We were warned' - Opinion

Breaking News: Breaking: Court Restrains Oyo Assembly from Further Impeachment Process Against Makinde’s Deputy, Olaniyan

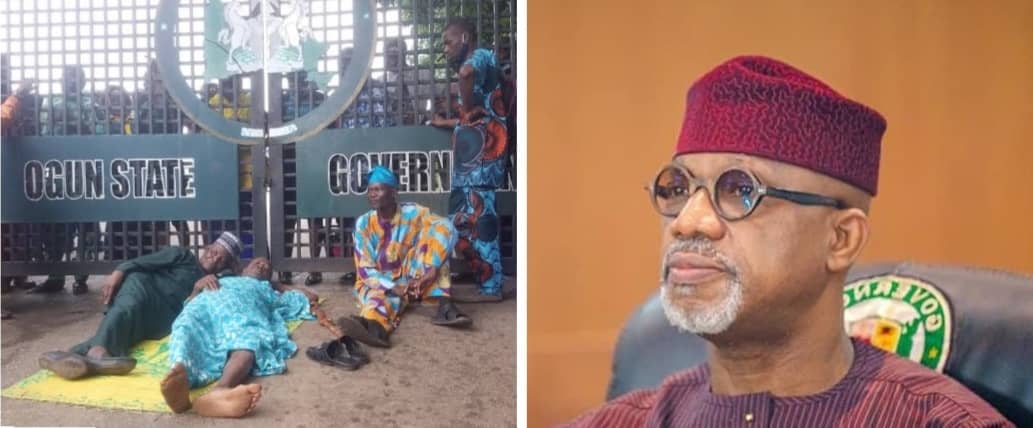

Breaking News: Labour leaders physically assault Ogun journalists for covering strike, harass hospital workers

Breaking News: Congratulations Asiwaju – Osinbajo’s spokesperson accepts defeat

Breaking News: Finalissima: Messi steals show, beats European Champion, Italy

The Central Bank of Nigeria, after the approval of President Muhammadu Buhari, has extended the period for which the old Naira notes of N200, N500 and N1,000 would seize to be a legal tender till February 17.

This was announced, Sunday, by the Central Bank Governor, Godwin Emefiele, following a meeting with the President.

According to the Governor, a 10 day extension of deadline from January 31 to February 10 was approved for the collection of more notes legitimately held by Nigerians.

He said a 7-day grace, beginning from February 10 to February 17 has also been approved to allow Nigerians deposit the old notes at the CBN after which the currency would have lost its legal tender status.

The CBN President said the decision was to give Nigerians with the notes, legitimately earned and trapped, the opportunity to deposit same at the CBN for exchange.

“Aside from those holding illicit/stolen Naira in their homes for speculative purposes, we do aim to give all Nigerians that have Naira legitimately earned and trapped, the opportunity to deposit their legitimately trapped monies at the CBN for exchange.

“Based on the foregoing, we have sought and obtained Mr President’s approval for the following: A 10-day extension of the deadline from January 31 to February 10 to allow for the collection of more old notes legitimately held by Nigerians,” the statement read.

“A 7-day grace period, beginning from February 10 to February 17, in compliance with Sections 20(3) and 22 of the CBN Act allowing Nigerians to deposit their old notes at the CBN after the February deadline when the old currency would have lost its Legal Tender Status.

“We, therefore, appeal to all Nigerians to work with the Central Bank of Nigeria to achieve a hitch-free process for the implementation of this very important program,” he said.

According to him, 75 percent of the N2.7 trillion held outside the banking system has been recovered during the process.

He said: “We are happy that so far, the exercise has achieved a success rate of over 75 per cent of the N2.7 trillion held outside the banking system.

“Nigerians in the rural areas, villages, the aged and vulnerable have had the opportunity to swap their old notes; leveraging the Agent Naira Swap initiative as well as the CBN Senior staff nationwide sensitization team exercise.

Emefiele explained that currency redesign was meant to be undertaken within a 5 5- 8 years window, adding that the bank had not been able to do that within the period of 19 years.

According to him, the aim of the redesign, apart from the function of the Bank, was to make monetary policy more efficacious, adding that same has begun to yield result with downward trend in inflation and stable exchange rate.

He also added that the decision was also aimed to support the efforts of the security operatives in combating banditry and ransom taking, adding that the military are making good progress in the important task in Nigeria.

The head of the apex financial regulator said available data had shown that currency-in- circulation in 2015 was only N1.4 trillion, while as at October 2022, currency in circulation had risen to N3.23 trillion, out of which only N500 billion was within the banking industry.

He said N2.7 trillion was held permanently in people's homes.

"Ordinarily, when CBN releases currency into circulation, it is meant to be used and after effluxion of time, it returns to the CBN thereby keeping the volume of currency in circulation under the firm control of the CBN.

"So far and since commencement of this programme, we have collected about N1.9 trillion; leaving us with about N900 billion (N500 billion + N1.9 trillion),'' the CBN Governor said.

According to Emefiele, to achieve effective distribution of the new currency, the CBN has taken some steps.

He said several meetings were held with Deposit Money Banks and they were provided with Guidance Notes on processes they must adopt in the collection of old notes and distribution of the New Notes, including directives that new notes should be loaded in ATMs nationwide for equitable and transparent mechanism.

The CBN Governor explained that the regulatory body worked with the media, print and broadcast, and the National Orientation Agency for sensitization of citizens, while 30,000 Super Agents were deployed nationwide, particularly in rural areas, regions underserved by banks and to reach the weak and vulnerable for currency swap.

To ensure compliance, Emefiele said staff members, mostly Assistant Directors, Deputy Directors and Directors in Abuja were sent to all CBN branches nationwide to join the mass mobilization campaign and monitoring programmes.

Fielding questions from newsmen, the CBN Governor said the excuse of security threats pushed by the Kano State Governor, Abdullahi Ganduje, had no bearing on the swap, which had achieved compliance and recorded huge success across the country.

"I don't understand the relationship between the CBN policy and security challenges in Kano State," he added.

He noted that all new currencies had security features that make it easy for tracking to bank branches, and the process had begun to deal with defaulters and those who breached the programme.

"Even if they are CBN staff, they will be sanctioned," Emefiele warned.

He thanked President Buhari for approving the re-design, saying an incorruptible leader of his status can give such approval to the CBN.

The CBN Governor also solicited the cooperation of all Nigerians in ensuring a hitch-free process for the implementation of the policy.

Before the apex bank extended the use of the naira note, many Nigerians experienced difficulty in lodging their old banknotes.

The scramble by many Nigerians to meet the initial January 31 deadline has been chaotic as many of them flood banking halls with huge cash in old notes to exchange them with new ones.

Others are seen in long queues at the few ATM points having the new naira notes in different parts of the country to have access.

The Presidential candidate of the Peoples Democratic Party, PDP, Alhaji Atiku Abubakar, had also called for the extension of the deadline on the ground that many Nigerians have suffered in their efforts to meet the deadline.

Newsletter

We are not gonna make spamming

Copyright By @ HorizonTimes - 2026

BACK TO TOP